T-Mobile debuts new 5G plan

T-Mobile last week announced a new rate plan, dubbed the Magenta Max, which takes full advantage of the carrier’s rich 5G network capacity. The new plan, which replaced the predecessor Magenta Plus plan, comes with unlimited Premium Data on both 4G and 5G networks (depending on network availability), unlimited UHD (up to 4K resolution) video streaming, and mobile hotspot with a 40GB data cap (up from 20 GB cap on the older Magenta Plus plan). The plan, like its predecessor, offers a free standard Netflix subscription, though customers of the new Magenta Max plan can enjoy free access to Netflix even if they have a single line (versus the 2+ line requirement on the older plan). T-Mobile kept the price of the new plan unchanged at $57/month for three lines with autopay. However, the carrier is running a limited-time promotion of a $10/line discount. The Magenta Max plan debut is complemented by a new switcher campaign called “Zero Cost to Switch”, where T-Mobile offers up to $650 per 5G device (in the form of a virtual prepaid card) customers bring over from AT&T and Verizon.

The NPD Take:

- T-Mobile’s new Magenta Max plan is a testament to its confidence in its 5G network assets and capacity that is (currently) unmatched by rivals. The mid-band spectrum assets acquired through Sprint give the carrier the network capacity to end “throttling” practices for heavy data users; this could be a game-changing marketing advantage as rivals heavily rely on throttling during network congestions.

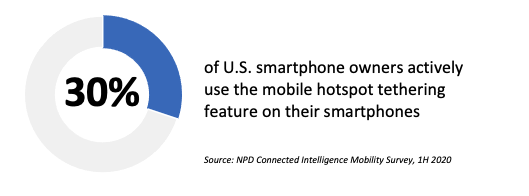

- The doubling of the mobile hotspot data cap from 20GB to 40GB will give T-Mobile additional marketing ammunition given the anticipated mobile hotspot usage increase in parallel to the increase in the mobility of consumers as the pandemic eases. According to NPD Connected Intelligence’s Mobility Survey, 30% of smartphone owners (38% of T-Mobile users) use the mobile hotspot feature actively to connect their Wi-Fi-capable devices (mainly tablets and laptop PCs) to the Internet. On the other hand, the expanding mobile hotspot data caps will have an adverse impact on connected tablet/PC adoption rates going forward.

Boost Mobile takes another hit

Dish Network last week released its quarterly operating results including the Boost Mobile prepaid business, which it acquired from Sprint as part of the T-Mobile/Sprint merger agreement. The company lost 361K subscribers (on top of the 212K subscribers churned in the previous quarter) to end the year with 9.05 million subscribers. The MVNO reported a quarterly churn of 4.88%, which is not only higher than all of its main rivals but is recorded at a time when the pandemic drove postpaid and prepaid churn levels to all-time low levels. Boost Mobile runs its operations as a wholesale MVNO on the T-Mobile network and is on the hook (enforced by the FCC) to deploy a wireless network covering 20% of the U.S. population by June 2022 and 70% of the population by June 2023. Dish holds a substantial amount of wireless spectrum and had a preliminary plan of launching a cloud-based OpenRAN 5G network by the end of 2020 on its spectrum. Dish announced that it has postponed this plan to a later time in Q1 2021 and that it will not have a major network operation until the second half of 2021. In the meantime, the MVNO is hit by T-Mobile’s recent announcement that it will shut down Sprint’s legacy CDMA network on January 1, 2022. This means that Boost Mobile customers using older LTE/CDMA phones will lose connection when out of an LTE zone once T-Mobile pulls the plug on the Sprint CDMA network.

The NPD Take:

- We had many times commented on Dish’s difficult task of adhering to its network build-out commitment while trying to maintain (and grow) the ultra-elusive prepaid base it has inherited from Sprint. The challenges of operating as an MVNO (versus being under the wings of a network running parent) coupled with the heavy promotional campaigns from prepaid rivals have resulted in a churn of close to 600K subscribers in its initial two-quarters of operation under the wings of Dish, and Boost Mobile will likely continue to report net losses in the quarters to come as increasing data usage in prepaid hurts Dish’s MVNO business model which is positioned around price competitiveness.

- T-Mobile’s announced close-down of the Sprint legacy CDMA network will have significant implications on Boost Mobile’s bottom line as the MVNO will have to force these users for a device upgrade that it will have to finance. Moreover, this upgrade cycle will give Boost Mobile’s rivals a genuine opportunity to target these upgraders with aggressive switcher promotions.