Cricket goes full speed on 5G

AT&T’s main prepaid arm Cricket Wireless’s user base has reached 12.4 million subscribers. The carrier’s announcement was accompanied by a restructuring of its rate plans, which now drops the previous 8 Mbps download speed cap implemented on all plans except the top-tier plan. Cricket’s top plan, which offers 5G unlimited 5G data (at full speeds), and comes with 15 GB Hotspot, HBO Max subscription, and one-year subscription fee for Sam’s Price Clubs remained unchanged. All the lower tier plans (including the entry-level 2GB plan), on the other hand, now include access to AT&T’s 5G network, and customers with 5G phones will enjoy the full speeds when in a 5G coverage area.

The NPD Take:

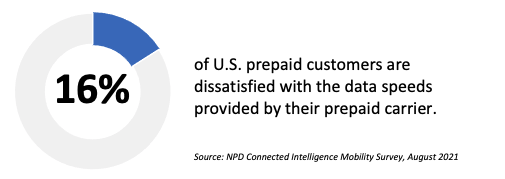

- Cricket’s removal of the 8 Mbps speed cap on its low-end and mid-tier plan stops brings an end to an uncommon practice we seldom see even at MVNOs who are not directly owned by a network operator. Incidentally, slow data speeds are prepaid users’ top dissatisfaction point with their service providers.

- With the public revealing of the existing customer base (12.4 million), we now know that Cricket accounts for 65% of A&T’s total prepaid user base (up from 58% in Q1 2019). Cricket, back in January 2019, announced the 10-million subscriber milestone, meaning it was able to grow the base by 2.4 million new lines in three years while most rivals have seen their bases shrink.

Cable MVNOs keep shining

Comcast and Charter last week announced the results of their Q3 2021 operations. Both cable MVNOs continued to ride the momentum they have been enjoying for the past several quarters and brought in a total of 529K new mobile subscribers. Charter’s Spectrum Mobile, which has passed the 3 million subscribers mark with the addition of 244K new mobile customers. Spectrum Mobile’s quarterly revenues increased by 45% YoY, while mobile-related operational costs were up 33%. Comcast ended the quarter with 3.7 million mobile subscribers, thanks to the newly added 285K new mobile customers. Comcast’s Q3 revenues grew by 51% YoY in parallel to the increase in the subscriber base as well as device sales generated during the quarter.

The NPD Take:

- Spectrum Mobile’s addition of 244K new subscribers is an impressive figure when compared against the postpaid carriers, but it is important to highlight that this was the lowest net add figure recorded for Spectrum Mobile since Q2 2019. Spectrum Mobile’s performance in Q4 2021 will likely be as strong as in the prior quarters given aggressive multi-line unlimited data plan pricing ($29.99/month per line) announced earlier in October.

- Cable MVNOs’ unique business model relying on a readily available user base to target has so far worked well as they were able to churn close to 7 million subscribers away from the top postpaid operators. The recent operational success was partially due to the limited mobility of consumers during the pandemic as the data traffic went through Wi-Fi networks. Both cable MVNOs cite that about 80% of the traffic goes through Wi-Fi but this figure will likely change in the long run as consumers return to their pre-pandemic routines.