Samsung teases a ring

At Samsung’s Unpacked event last week, the big news was obviously the launch of the S24. But the company ended the event by (sort of) unveiling of a ring device. Details were sparse to nonexistent, but it’s a safe bet that this is a health monitoring device that will track the usual fitness details, as well as sleep tracking. In other words, exactly the same metrics that Oura tracks and, for that matter, the same metrics that smartwatches track.

Samsung is hardly alone with this goal. 2023 saw the launch of the Ultrahuman Ring Air, Circular Ring Slim and Movana Evie Ring and CES highlighted an array of other possible ring entrants too, which means this niche category looks set to be quite crowded quite quickly. Of course, Samsung has a competitive advantage over the majority of these thanks to its brand, as well as a broader ecosystem of devices. As a result, Oura (the ring incumbent) will be the company to beat over time while many of the others will struggle to gain traction.

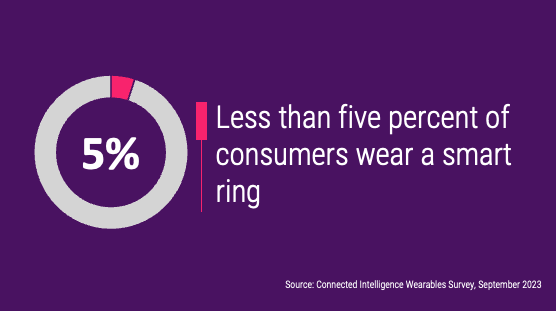

But “beat” is a relative term as this is a nascent market. We estimate less than 5 percent of US consumers own a ring and we remain less than convinced that this is a growth market that will rival the smartwatch. The ring is a passive device: it sits there, monitoring, but provides no direct insight. Rather, the wearer needs to view the app on the smartphone to see the details. A watch, by contrast, provides immediate response via the display and contains the killer app of telling the time (yes, the vast majority of watch wearers cite “tells me the time” as the biggest use case). Further, a watch is a Swiss army knife of devices, providing notifications, music streaming, fitness tracking and more, while the ring is far more limited in what it can do.

The crux of the matter will be how Samsung positions the ring device. As we mentioned previously, the company has the key advantage of a broader ecosystem and could use the ring in association with its smart home features; for example, to make home devices aware of the person’s location – open locks, change temperature settings and so on – as well as being seen as an additional sensor that complements the smartwatch rather than competing against it. With that approach, there’s a chance. But as a standalone health monitoring device? That’s a less likely road to success in our view.

The Circana Take:

- This is a nascent market with a lot of challenges, not least the fact that rings are relatively bulky and therefore not that comfortable.

- The smart ring needs to be positioned as a complement to the smartwatch. Otherwise Samsung will simply be competing against its existing devices rather than broadening the market opportunity.

- While we are very cautious about the opportunity for the smart ring, it’s still a good move for Samsung. If the ring market does pick up pace it means the company is leading the charge rather than scrambling to catch up later.

Apple sidesteps the patent ban

The ongoing saga of Apple’s patent dispute with Masimo continues. After a ban, followed by a stay of execution, followed by a stay on the stay… Apple seems to have come up with a solution and will now sell its latest smartwatches without access to the blood oxygen feature. It’s a neat solution for the company as it allows Apple to continue selling the devices without any changes to the hardware and, once (if?) there is a resolution to the patent dispute, Apple will be able to simply upgrade the software to open up the feature. And, of course, Apple continues to appeal the patent infringement claims. Meanwhile, Masimo took its prototype consumer watch to CES. But the company is playing it very safe… the device is round.

The Circana Take:

- Apple’s solution seems to have met with approval and means the company can continue to sell its smartwatches.

- Existing customers of the Ultra 2 and Series 9 are unaffected and can continue to use the Blood Oxygen features. This software change only impacts new customers.

- While the lack of this feature may provide some marketing fodder for competitors (Garmin for example) the reality is that most smartwatch wearers will not miss the feature as it is typically only needed for very active exercisers.

Apple Vision Pro debuts and sells out

Apple opened the Vision Pro spatial computing device for pre-orders last Friday and, as expected, the device sold out in a matter of hours with shipping availability slipping into March. As of this Monday morning, Apple does not commit to delivering the device to any U.S. address before March 5. Notably, Apple Vision Pro became available for pre-orders in the US in storage options (256 GB at $3,499, 512 GB at $3,699, 1TB at $3,899) and all three variants sold out within couple hours.

The Circana Take:

- This is what we wrote on Apple’s iconic spatial computing device when it was first announced back in June 2023, and our analysis remain unchanged:

“There is no question that the Vision Pro+ is expensive and at the same time we have no doubt that Apple will have difficulty keeping up with the demand (due to a controlled supply strategy) even at this price point. We are not going to get into the arguments about why the price is so high or why it is justified because it converges so many different product categories into a unique form factor offering an immersive experience; this is a 1.0 product, and it is not targeting the mass market.”

- Despite its limited reach due to low supply and extremely high price, the commercial availability of the Vision Pro will give Apple the ability to boost its marketing on the latest iPhone 15 Pro models, which can capture spatial videos. Apple and its carrier partners can convince potential iPhone 15 buyers to purchase the more expensive iPhone 15 Pro variant instead for future proofing purposes. While the second or even the third generation of the Vision Pro device will be out of reach for many of these consumers, future proofing is a straightforward way to persuade users to the upper tier 15 Pro model.