PORT WASHINGTON, NEW YORK, SEPTEMBER 5, 2014 – Smartphones with screens 4.7 inches and larger are commanding more shelf and unit share in the U.S.

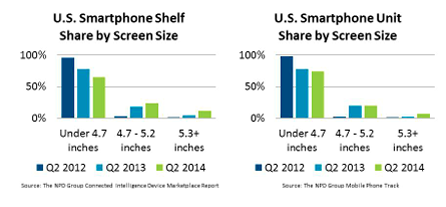

According to The NPD Group Connected Intelligence Device Marketplace Report, U.S. nationwide carriers devoted about a third of their shelf space to devices with a 4.7 inch or larger screen in the second quarter (Q2) of this year, up from just 4 percent in Q2 2012. Sales growth has lagged, however, behind product availability. U. S. sales of smartphones with 4.7 inch or larger screens now account for more than a quarter of sales, up from 2 percent in Q2 2012 according to NPD Mobile Phone Track.

Cellular data consumption is growing as smartphones get bigger. According to the Connected Intelligence SmartMeter, consumers with smartphones that have 4.7-inch and larger screens use about 4GB of data a month, twice that of consumers who own smartphones with smaller screens, and video is the top application driving this data consumption growth.

“Larger screens mean a much richer content experience for smartphone users,” said Brad Akyuz, director, NPD Connected Intelligence. “The increase in video consumption driven by large-display smartphones is a tremendous revenue opportunity for network operators, as consumers will need more data to enjoy content on-the-go”.

“While interest among U.S. consumers in larger screen smartphones is growing, sales growth has been relatively disappointing over the past two years due to Apple’s dominance of the market,” said Stephen Baker, vice president, industry analysis, NPD. “All the demand, channel and usage pieces are in place for larger smartphone sales and share to increase. If Apple releases a bigger iPhone it will be the final catalyst for explosive growth in the 4.7”+ market.”

Larger smartphones have been more of a supplier push than a consumer pull, and suppliers plan to continue the increase supply. According to NPD DisplaySearch, North American shipments of 4.7-inch and larger smartphones are forecast to reach 120 million in 2014 and grow to 179 million by 2018.

Methodology

Connected Intelligence Device Marketplace Report

The Devices Marketplace Report leverages data from the NPD Connected Intelligence's monthly deployed retail store surveys conducted at direct and indirect retail channels. The report tracks the retail pricing and availability of mobile phones (feature phones and smartphones) and various other mobile broadband device categories including tablets, mobile hotspots and USB modems. Tracked service operators include AT&T, Boost Mobile, MetroPCS, Net10, Sprint, Straight Talk, T-Mobile, Verizon Wireless and Virgin Mobile.

Connected Intelligence SmartMeter

The Connected Intelligence SmartMeter is an opt-in on metering solution that resides on consumers’ smartphones and tablets.

NPD Mobile Phone Track

The NPD Mobile Phone Track reports on the activities of U.S. consumers, age 18 and older, who reported purchasing a mobile phone or smartphone. NPD does not track corporate/enterprise mobile phone purchases.

About Connected Intelligence

Connected Intelligence provides competitive intelligence and insight on the rapidly evolving consumer’s connected environment. The service focuses on the three core components of the connected market: the device, the broadband access that provides the connectivity and the content that drives consumer behavior. These three pillars of the connected ecosystem are analyzed through a comprehensive review of what is available, adopted, and consumed by the customer, as well as reviewing how the market will evolve over time and what the various vendors can do to best position themselves in this evolving market. For more information: http://www.connected-intelligence.com. Follow Connected Intelligence on Twitter: @npdci.

About The NPD Group, Inc.

The NPD Group provides global information and advisory services to drive better business decisions. By combining unique data assets with unmatched industry expertise, we help our clients track their markets, understand consumers, and drive profitable growth. Sectors covered include automotive, beauty, consumer electronics, entertainment, fashion, food / foodservice, home, luxury, mobile, office supplies, sports, technology, toys, and video games. For more information, visit www.npd.com and npdgroupblog.com. Follow us on Twitter: @npdtech and @npdgroup.

About NPD DisplaySearch

NPD DisplaySearch, part of The NPD Group, provides global market research and consulting specializing in the display supply chain, including trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. NPD DisplaySearch supply chain expertise complements sell-through information from The NPD Group, thereby providing a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information, visit us at www.displaysearch.com. Read our blog at www.displaysearchblog.com and follow us on Twitter at @DisplaySearch.

CONTACT:

Sarah Bogaty

+1 516 625 2357

sarah.bogaty@npd.com