HBO GO is Gone

Go, Now, & Max, in addition to straight up HBO made for a confusing launch of HBO Max. Consumers don’t do well with brand confusion. Just think back to HD DVD when many thought they had those shiny new high-definition discs because they had a DVD player and an HD TV. For HBO, the TV Everywhere variant GO did its job and now it’s time for GO to go (July 31). Don’t fret, most viewers that used the GO app can now simply cut over to Max. But… it still won’t be on Roku or Fire TV and that will be a problem for the masses that use those platforms to stream.

The NPD Take:

- Streamlining the branding is a critical step as the HBO value proposition got complicated with the introduction of a third streaming app.

- It can’t be said enough, Roku and Fire TV reach a net of 37m U.S. homes. These are the go to streaming devices and HBO will risk losing an audience to those not willing to find its app elsewhere.

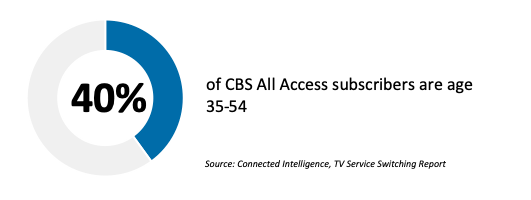

CBS All Access’ Getting Maxed Out

It’s official, CBS will be relaunching All Access. In the wake of mega media conglomerates launching expansive streaming services such as Disney+, Peacock and HBO Max, CBS is following suit. The company will be adding 15,000 hours of new Viacom and CBS programming to CBS All Access’ existing 15,000 hours. The reimagined service won’t continue to succeed on just targeting the traditional older CBS audience. Programming from the likes of Nick and MTV will flank CBS and expand its value proposition to a broader demographic audience.

The NPD Take:

- The game has changes since 2014 when CBS launched All Access. While the company was first in, the service hasn’t evolved in a manner that would compete well in the 2020s streaming environment. A strategy shift was inevitable and enabled by the CBS-Viacom merger.

- Networks have become the new distributors, garnering more of the ad-revenue directly and finally benefitting from the migration to streaming.

Basic cable is beholden to cable

As a premium network it’s easier to decouple from cable and offer a direct-to-consumer service. Among other things, viewers are accustomed to paying specifically for their programming. And, broadcast channels also have a unique position as their programming is available for free over-the-air and through re-transmission deals. That leaves the likes of basic cable network in a more channeling position as their revenues are heavily beholden to the cable bundle. As such, it’s critical to develop a strategy that both sets a future streaming path and doesn’t undermine cable distribution TV deals. Discovery Communication is at the cross hairs of these challenges. The company is working hard to find the right balance and approach to enter the DTC streaming video space. To that end, Discovery CEO David Zaslav has been in active conversations with distribution partners to determine the game plan.

The NPD Take:

- It’s time, in fact it’s late. The pay TV subscriber base continues to shrink and with it the ability to generate ad revenues from those distribution deals. Discovery will need to launch a streaming option quite soon to protect its revenue stream.

- It’s tricky, very tricky. While the company boasts an enormous array of unique, non-scripted content, it’s not the type of programming viewers are used to paying for on its own. It is and has been a staple of basic cable.