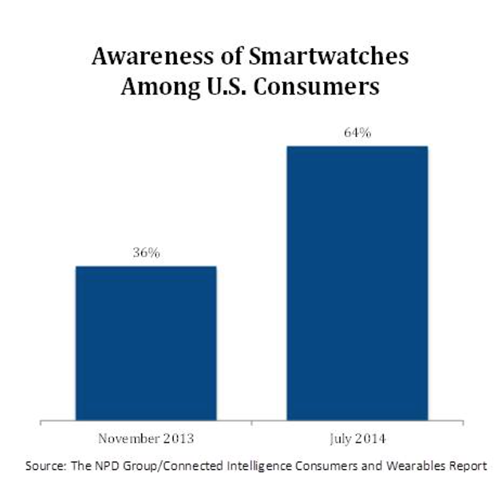

This holiday season will be the first major test for the smartwatch category. One year ago the category was immature, with only a small handful of devices in market; the majority of which were not from known brands (the exception being Samsung’s initial Gear watch). Awareness of the category was also fairly low, with only 36 percent of the U.S. market showing any awareness whatsoever.

Fast forward to the present and the situation is very different, with multiple key smartphone brands now pushing out their initial watches and, of course, Apple having announced its Watch device, although this will not be available in time for the holiday season. Awareness has also increased significantly, with 64 percent of consumers now aware of the watch category (July 2014). This has undoubtedly increased even further subsequent to Apple’s announcement in September.

So far, so good. But what hasn’t changed too much in the past nine months is the ownership, which has hovered around 2-3 percent to date. Indeed while we have seen awareness almost double, the intent to purchase has remained in single digits.

One of the biggest issues that smartwatches appear to be facing is that consumers are not quite sure why they need one. The most significant use cases to date revolve around fitness related options and alerting capabilities. That leads to an interesting situation because activity trackers are starting to evolve beyond basic step counting to add other functionality. Samsung’s Gear Fit and Microsoft’s new Band both support alert features, in addition to the more sporty features required of this base, and they cost significantly less than smartwatches, as do the new Fitbit devices. All of these factors, we expect will add up to a strong holiday season for activity trackers.

However, the watches could still drive more consumer appeal because of the “smart” part of this equation; the concept that they can support multiple apps just like a smartphone. This means that while consumers need to have a little faith that the apps will come, they know that there is a strong track record from developers to build interesting solutions for these platforms.

The holiday season will be a good first indicator of how much the consumer’s faith in this category will translate into actual purchases, with, of course, the obvious omission of the Apple Watch. This will mean that most growth will come from the Android community while the current iPhone users sit back and wait for a spring smartwatch revolution.